Shell’s Technology Future: iShale, Permian, Deep Water | Exclusive Interview

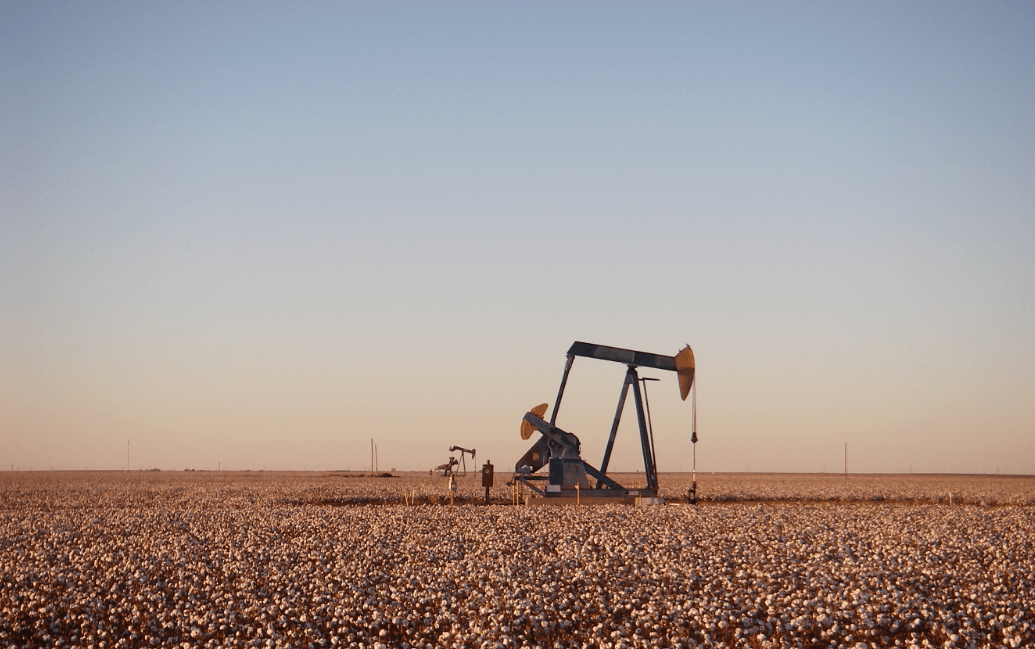

To provide a glimpse into the quality of discussion at our upcoming North American Gas Forum, we are presenting an exclusive insider view on Shell’s technological advancements, iShale™ initiative, and recent activity in the Permian Basin.

We turned to Amir Gerges, Shell’s General Manager for Permian, a member of the Board of Directors at Texas Oil & Gas Association (TXOGA) and a Fellow of the Energy Institute (FEI). Throughout his career, Amir has held significant technical and business leadership roles for Shell in the UK, Norway, Russia, Egypt, The Netherlands and the US. Prior to his current role, Amir was Vice President of Strategy & Planning for Shell in the Americas, and Integration Lead for Shell’s acquisition of BG.

During our discussion, we talked with Amir about the recent technological advancements in drilling, remote sensing, monitoring, and deep water operations that have been driving progress for Shell. Here is our conversation:

ED: What kinds of insights are being gained by big data that allow Shell to accurately predict the production potential on a scale as large as the Permian?

AG: The oil industry in general, and Shell specifically, has used data from the very early days. The data we used in the past was primarily driven by subsurface data. Now, we use the subsurface data to understand the behaviors of the reservoir, and then use relevant data we collect from our machines and our equipment to try and predict how these machines and surface equipment are going to behave in the future.

ED: Tell us about iShale™ from your perspective.

AG: In late 2016, early 2017, I was heading a group that was looking at the future of the shale business, and we gave it a name, a funky name. We trademarked and registered that name – we call it iShale™.

Essentially, iShale™ is Shell’s vision for what the shale field of the future could look like, and it focuses on two things. It is looking at a step change in the way we design, build, and operate shale fields today. We wanted to do this with the collaboration of our strategic partners that help us build and develop a shale field. Secondly, we looked at using automation and digitization to improve the productivity of our field, but also of our people, and ensure that we have the lowest-impact footprint from our operations. We considered the existing technologies today that have been de-risked by other industries, like the aviation industry, for example, that could be adopted in the shale business.

ED: When will iShale™ come into play in the Permian?

We are working to have the first prototype of iShale™ operational in the Permian before the end of 2019. We’re doing that in collaboration with our strategic partners. That is where we bring automation, digitization, and advanced analytics into play. This is not something that we’re going to develop over the next five to 10 years, but over the coming months!

The changes in the Permian happen so fast. Every day, and every week, there are new facilities that are being built, because there are over a hundred operators in the basin. These operators are sharing a majority of the common infrastructure, like roads, power grids, bridges, pipelines, rail, etc.…and the industry footprint in the basin is evolving rapidly. This means that the infrastructure we need to build, and the access we require, will also depend on where our competitors place their facilities.

ED: With initiatives like iShale™, drilling and monitoring processes are becoming increasingly automated, mechanized, and precise. Which technologies are you championing, or are you most excited about?

AG: Your Apple watch that you have now has probably 10 to 20 sensors. It checks temperatures, pressures, it has a signal with a satellite, it can check your heartbeat. These are all digital sensors that are not widely used in the oil industry today. The watch is $300 and it has 20 sensors. Just imagine if we can deploy these small, low power, very intrinsically safe digital sensors down a hole in a wellbore, or these small, minute cameras in our shale business. What could that do to the way we operate and survey our equipment?

You can take this even further. Imagine mounting sensors on drones and deploying them to conduct routine surveys, such as methane leak detection.

ED: What are the advantages you’re seeing with remote sensing? What are the drawbacks?

AG: I struggle to think of a drawback. If you think about it, it’s a technology that is available today and is open to everybody, to all players.

Let’s take remote sensing as an example, using a very high definition satellite. It’s available to us, as well as our competitors. It all depends on how we use it, and how quickly we use it to learn, advance, and change our plans, versus our competition. Currently, we use remote sensing primarily to check our right of way, to see if we can put a facility or run a pipeline on that land. We can use remote sensing information very quickly to change and update our plans, versus some other company that will have week-old or month old-data, because that’s when they completed a land or an aerial survey.

ED: You have mentioned that the potential for automation has not yet scratched the surface. What will a Shell Permian project look like in the next five years?

AG: Today, we have about 450 facilities that Shell operates in the Permian. These facilities could be a well site, a pipeline, a pumping station, a processing plant, or a water disposal station. We are expected to grow exponentially over the next three years, given our plans and our ambitions in the Permian. The important thing is that we should avoid trying to proportionally increase our manpower requirements that use technology. We would like to ensure that we can utilize the same operator to look after 50 wells, instead of only 20 wells. But more importantly, our aim is to keep people out of harm’s way, particularly off the roads, and provide them with sufficient technology that allows them to safely operate their facilities

To get there, they will need to have digital imagery and real-time information. They need to have the right signals coming from the well, and wireless information. They need to be able to transmit and communicate with their co-operators from the control room to the well site without the need of pulling a cable in between. These are all what we think the efficiencies of the next generation of shale fields will look like. I don’t think we are there yet. But, in Shell, we have made a conscious decision to shape the technology landscape in Permian, and across our shale portfolio.

ED: What have you learned from deep water operations that can be applied to shale projects?

AG: In deep water, we could not send operators deep down in 1,000 meters of water depth, because you cannot dive at that location. Instead, we utilized remote operated vehicles, ROVs. Given the scale we have in operations now regarding shale, we are pushing automation as far as we can, based on the technologies we have adopted in deep water.

Again, the primary goal here is not cost reduction, or efficiency gain to improve profits. It is reducing the risk exposure to our people. And that’s what we do very well in deep water. The same can be achieved in shale. As I mentioned earlier, we are developing digital sensors, which can be programed to do the leg work for our operators and reduce our road safety exposure in the Permian Basin.

ED: What is the local economic impact within the Permian because of the switch from manual labor to automation? Do you find that with the technology being implemented that jobs will be lost?

AG: Absolutely not. The technology is not going to take people out because the growth is going to outpace the need for people. If we don’t change the way we operate, we will not have enough people to operate, and grow, and deliver that growth. That’s the challenge – not to change our staffing models, but to make our staff more efficient to be able to grow that business. We want to increase the digitally connected, cross-trained, broadly skilled workforce that leverages technological innovations in their everyday work to drive efficiency gains and keep up with the growth. It’s what I call “uberization” of the shale business.

Permian is growing at an exponential rate. According to a recent IHS Markit outlook published this month, oil production from Permian will more than double to 5.4 million bpd by 2023. If it were an OPEC member, the region in West Texas would be second only to Saudi Arabia. The ability to grow our skilled operators at that rate is unheard of. There is no basin in the world that is growing at the pace that we’re experiencing in the Permian. So, to keep up with that growth, you need to ensure that the operators you’re bringing onboard can do more with what they have today than what they are used to, without compromising safety.

The other thing is that a lot of our operators spend about three or four hours on the roads in Permian, traveling to work and checking their facilities. If we can take them off the road, which remains our biggest risk, they will be able to do more during their daily shift.

I think automation is going to create bigger, more important roles, and improve the overall staff productivity. I doubt we will see a decline in employment because of technology. On the contrary.

ED: Do you predict the Permian or deep water production might be higher on Shell’s agenda?

AG: I have been with Shell for 21 years now, most of it in offshore, and a lot of it in deep water. So, I don’t think it’s Permian or deep water, I think it’s Permian and deep water, or shale and deep water, and there is uniqueness in both.

The unique thing about North American light tight oil (LTO), specifically, or light tight oil, is that it’s a very shallow investment that pays back very quickly, and is very repetitive. This financial business model offers you flexibility to ramp up and ramp down, depending on the commodity prices, or the oil price. It is complementary to deep water projects, where you go into deeper cash sink, and deeper investment, but they pay out quickly and stay online for a fairly long time.

An integrated major, like Shell, needs to have both parts of the business model in the portfolio, so you can have a robust financial model and balance sheet for the company. The shale investment provides you flexibility to dial up and down, and the deep water gives you stable cash flow for a very, very long time. Where companies struggle is when they are overweight in one business over the other.

ED: Can you tell us a little bit about your experience attending Energy Dialogues events?

AG: Let me start by thanking Energy Dialogues, Rice University, and Baker Institute for organizing these dialogues. The last Energy Dialogues discussion I attended was in April, and myself personally, and also Shell feels that the Houston Energy Dialogues makes an extremely valuable contribution to fostering an open discussion with our stakeholders.

I’ve attended two Dialogues. The debates that we have had at both have been more objective, and less emotional. Everybody that has joined the dialogue, including partners, operators, service companies, NGOs, and thought leaders, have engaged in objective discussions on how do we, together, move the energy businesses forward, and strive through this energy transition. You probably have read a lot about where Shell stands in the energy transition, and utilization of natural gas as a transition fuel. And I feel having a construct, like what Energy Dialogues enables, is very important to ensure that the societal acceptance around our operation is there.

What I hope we can do is expand that catchment, expand the representation in the energy dialogue, and encourage many of those companies that are currently not active in this space to come along. And hopefully we can move some of these debates forward in the right direction, in collaboration with our stakeholders, so they feel they are also part of the solution together with the other energy companies.

I can tell you that I will not miss another Energy Dialogues going forward. It was very impressive, and I think it’s the right type of conversation, the right type of representation that we need to have.

Join us to discuss the technology future of our industry and more at the North American Gas Forum – October 2018

Join us to discuss the technology future of our industry and more at the North American Gas Forum – October 2018

The North American Gas Forum is dedicated to bringing together an impressive line-up of industry decision makers from across the natural gas value chain. The forum will be held on October 14-16 in Washington D.C. Join us for high-level discussion and debate, with topics ranging including natural gas development changes, big data, methane emissions, storage infrastructure, smart regulation, and more.

To learn more, and to reserve your spot, please visit http://energy-diagloues.com/nagf/