We Are The World – The Continuing Evolution Of The International LNG Market

Ahead of the 2016 North American Gas Forum, Rick Smead, Managing Director, Advisory Services with RBN Energy LLC took a closer look at last year’s take aways from the forum, the energy industry’s evolution over the last year and what participants can look forward to at Energy Dialogues LLC’s annual fall event, taking place Oct. 2-5 in Washington D.C.

Read below an excerpt of the article and the full post can be found on the RBN Energy LLC website.

Published by: Rick Smead, Managing Director, Advisory Services, RBN Energy LLC

Despite the doom and gloom that many see in the global LNG market –– too much supply, weak demand growth, and low LNG prices –– the possibility remains that the sector may offer the opportunity for low-cost, highly responsive market participants to do quite well, and even thrive. How can that be? After all, we’ve just seen another year of low crude oil prices resulting in very low oil/natural gas margins, and the expectation of high oil/gas margins were critical in supporting the development of many U.S. liquefaction/LNG export projects. But a combination of responsive demand, low cost infrastructure development and the possibility that number of exporting countries could run out of gas at or near the end of their existing contracts could change the outlook for ongoing LNG export development. Today, we look at the LNG market in the context of themes discussed at the North American Gas Forum (NAGF). Warning: this blog includes a plug for this year’s NAGF conference.

Each fall, the NAGF gives natural gas producers, pipeline companies, LNG exporters and importers, major gas consumers and government officials an opportunity to examine the state of the natural gas industry in North America and debate policy directions. As in 2015, this year’s NAGF is expected to give particular attention to the international LNG market, which has been seen as “the next big thing” driving gas demand growth. At last year’s forum, the president of one of the major U.S. developers of new liquefaction/LNG export capacity presented an interesting and thorough assessment of the global LNG market into which the U.S. export projects are beginning to compete. Today, we look back at that presentation, and consider the challenges –– and potential –– ahead for U.S. LNG exporters in 2017 and beyond.

The NAGF is a prestigious, high-level policy gathering held each fall in Washington, DC –– this year’s forum runs October 2-4. Last year, in his presentation, Octavio Simoes, president of Sempra LNG (which is a partner in the Cameron LNG project now under construction in southwestern Louisiana) examined the gas demand markets in Europe and Asia; the development of indigenous gas supply in those regions; the fight for market share between pipeline gas and LNG; and the relative competitiveness of U.S. LNG export projects. In his talk, Mr. Simoes acknowledged the market’s challenges, but also reminded attendees of what spurred development of the first round of U.S. liquefaction/LNG export projects in the first place –– and why those drivers remain relevant today.

For years, the vast majority of the world’s long-term LNG purchase-and-sale agreements (PSAs) –– especially to Asia –– have been indexed to oil, that is, priced at some thermal equivalent of crude. Back when oil was selling for $90/bbl (the equivalent of $16/MMBtu), the plan by prospective U.S. LNG exporters to link their LNG prices to Henry Hub natural gas prices (and not oil) appeared to give them a real leg up. Gas from highly productive U.S. shale plays was selling for only $4.00, leaving a whopping $12/MMBtu that could be invested in a liquefaction/LNG export project or go to the bottom line of the LNG seller. Better yet, many of these same developers had only recently built U.S. LNG import terminals under the pre-Shale Revolution assumption that the U.S. was running short on domestic natural gas about to become a major LNG importer.

Fast forward to today, with oil at about $47/bbl (about $8/MMBtu) and gas at $3.03/MMBtu (both are the current 12-month strip prices), the oil/gas margin is only about $5.00 per MMBtu –– below what a lot of liquefaction/LNG export projects have ended up costing. Worse yet, shale plays have become the responsive supply for both oil and gas, suggesting that the days of a big, fat margin between oil and gas prices (on an MMBtu basis) are behind us for good. Meanwhile, spot LNG prices have been extraordinarily low, both in Asia and in Europe. Low oil prices aren’t the only culprit here. The problem is there’s just more LNG out there than the market is ready wants to absorb right now. There are a few reasons for that supply/demand imbalance, one being the fact (noted just above) that the U.S. itself had been expected to emerge as a major LNG demand sink. Consider the Energy Information Administration’s (EIA) 2008 Annual Energy Outlook (AEO), which projected (red line in Figure 1) that by 2016 the U.S. would be importing the LNG equivalent of 6.6 Bcf/d (just under 50 million metric tons per annum, or MTPA, of LNG). The black-and-blue line shows how LNG imports actually fell (black line) and how EIA predicted in its 2016 AEO that the U.S. in 2016 has actually flipped to becoming a net LNG exporter (blue line). Essentially, the U.S. turned away about 15% of the total world LNG supply, but the potential suppliers in Qatar, Nigeria, etc., had already built the capacity to supply it.

Another reason international LNG supply/demand is out of whack is that U.S. (and Australian) developers, thinking they would have a competitive edge in the global market, started building a lot of new liquefaction capacity. Now, all that capacity is coming online –– unfortunately just as LNG demand growth either stalled (in LNG-importing mainstays like Japan and South Korea) or slowed (in up-and-coming countries like China and India).

Another reason international LNG supply/demand is out of whack is that U.S. (and Australian) developers, thinking they would have a competitive edge in the global market, started building a lot of new liquefaction capacity. Now, all that capacity is coming online –– unfortunately just as LNG demand growth either stalled (in LNG-importing mainstays like Japan and South Korea) or slowed (in up-and-coming countries like China and India).

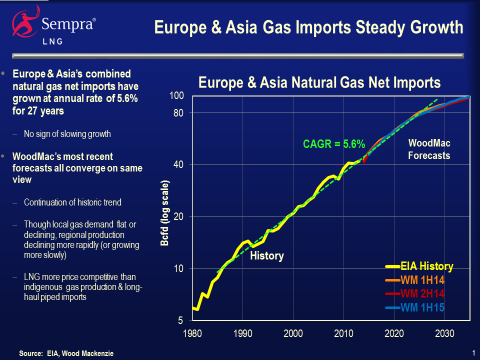

But coming back to what Mr. Simoes and other major developers were thinking at NAGF last year. What did they expect to happen to Asian and European gas markets? All were surprisingly optimistic, given the dark clouds that had already gathered. Figure 2 is the estimate Sempra LNG presented for all natural gas imports (via pipeline or as LNG) to Europe and Asia combined. Using EIA historical data and then-recent estimates from Wood MacKenzie (WoodMac), Sempra LNG projected that total gas imports to Europe and Asia would grow at a compound annual growth rate (CAGR) of more than 5%, partly due to gas-demand growth and partly due to slow growth in indigenous gas production.

Figure 2; Source: Sempra LNG

This brings us to a tough question for U.S. project developers and the folks who lend them money: It’s fine that there’s a positive outlook for LNG demand growth in Europe and Asia, but what kind of competitive position do new U.S. exporters occupy in this very tough environment? The estimate for total incremental LNG demand in Figure 3 is about 44 Bcf/d by 2025; U.S. developers have applied for about 60 Bcf/d of export authority. Capturing 140% percent of the expected growth would seem like a long-shot –– literally impossible of course! Something more like the 13 Bcf/d or so of U.S. liquefaction/LNG export capacity that is currently well underway –– or about a third of the global market growth –– is more likely, meaning that growth beyond the current batch of underway projects is going to be difficult.

TO READ THE FULL ARTICLE, PLEASE VISIT https://rbnenergy.com/we-are-the-world-the-continuing-evolution-of-the-international-lng-market